An Unbiased View of Life Insurance Quote Online

Table of Contents10 Simple Techniques For Senior Whole Life InsuranceSome Ideas on Whole Life Insurance You Need To KnowCancer Life Insurance Things To Know Before You BuyExcitement About Whole Life InsuranceThe smart Trick of American Income Life That Nobody is Talking About

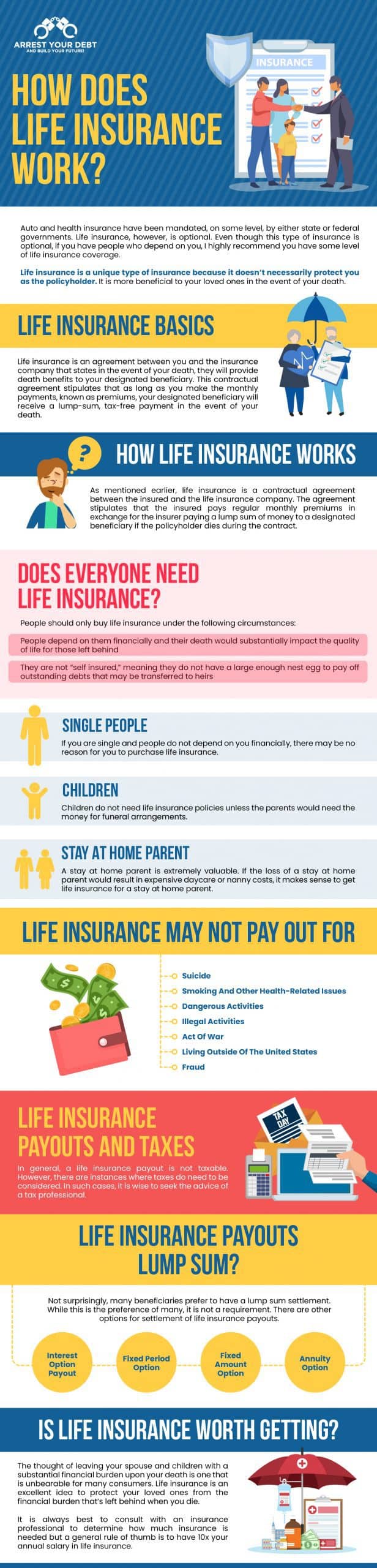

Life insurance policy provides monetary protection for individuals you appreciate. You pay a regular monthly or annual premium to an insurance policy firm, as well as in exchange the business pays a tax-free lump amount of money to your beneficiary if you die while the plan is active. You can personalize your life insurance plan to fit your family's needs by selecting the kind of policy you acquire, the variety of years you desire it to last, and also the quantity of cash paid out - American Income Life.Life insurance policy is an extremely common property that figures right into lots of people's lasting economic preparation - Life insurance online. Investing in a life insurance plan is a way to safeguard your liked ones, offering them with the financial support they might need after you die. As an example, you might buy life insurance policy to aid your spouse cover home loan payments or daily expenses or fund your kids's university education.

Secret Takeaways Life insurance policy is an agreement in between an insurance policy holder and also an insurance coverage company that's designed to pay out a death advantage when the guaranteed person passes away. A life insurance policy firm should be spoken to as quickly as possible complying with the death of the guaranteed to begin the cases and also payout procedure - Life insurance company.

See This Report about Life Insurance Louisville Ky

There are different ways a recipient might receive a life insurance coverage payout, including lump-sum repayments, installment payments, annuities, as well as maintained asset accounts. Watch Currently: What Is Life insurance policy? Life Insurance Policy Essential Life insurance policy is a kind of insurance coverage contract. When you buy a life insurance policy plan, you agree to pay costs to maintain your coverage intact.

Some life insurance policy policies can offer both fatality benefits and also living advantages. A living advantage biker enables you to use your plan's survivor benefit while you're still active. This type of rider can be helpful in circumstances where you're terminally ill as well as need funds to pay for healthcare.

These policies enable the policyholder to be the beneficiary of their very own life insurance policy plan," claims Ted Bernstein, owner of Life Cycle Financial Planners LLC. When purchasing life insurance policy, it's important to take into consideration: Just how much insurance coverage you need Whether a term life or permanent life plan makes extra sense What you'll pay for costs Which motorcyclists, if any kind of, you wish to include The distinctions in between life insurance policy prices quote for each prospective policy In regards to protection amounts, a life insurance coverage calculator can be valuable in picking a fatality benefit.

Some Known Questions About Kentucky Farm Bureau.

Life insurance policy premium costs can depend pop over to this web-site on the type of policy, the quantity of the death benefit, the motorcyclists you consist of, and also your overall health.

Small children can not be called as recipients of a life insurance coverage plan. Submitting an Insurance claim Fatality advantages are not paid out immediately from a life insurance plan.

Some Known Questions About Life Insurance Companies Near Me.

There's no collection due date for how much time you have to submit a life insurance policy case yet the sooner you do so, the better. When Benefits Are Paid Life insurance policy advantages are normally paid when the insured celebration dies. Beneficiaries file a death claim with the insurer by sending a licensed duplicate of the death certificate.

If a business refutes your claim, it normally offers a reason. The majority of insurance provider pay within 30 to 60 days of the day of the case, according to Chris Huntley, owner of Huntley Wealth & Insurance Providers. "There is no collection timespan," he includes. "Yet insurer are inspired to pay immediately after receiving bona fide evidence of death, to prevent steep rate of interest charges for postponing repayment of cases." Payment Delays There are numerous feasible scenarios that may result in a hold-up in payment.

The Best Guide To Term Life Insurance Louisville

The reason: the one- to two-year contestability condition. As long as the insurance policy business can not prove the insured lied on the application, the advantage will typically be paid," states Huntley.

If you or a person you know is enduring from depression or mental health concerns, obtain aid currently. It's available 24 hours a day, seven days a week, and also offers totally free and private assistance.